MACD Divergence – Fully Automatic Indicator ThinkorSwim TOS Script

MACD Divergence – Fully Automatic Indicator ThinkorSwim TOS Script

MACD Divergence – Fully Automatic Indicator ThinkorSwim TOS Script

Product Delivery: You will receive a download link via your order email

Should you have any question, do not hesitate to contact us: support@nextskillup.com

$47.00

Secure Payments

Pay with the worlds payment methods.

Discount Available

Covers payment and purchase gifts.

100% Money-Back Guarantee

Need Help?

(484) 414-5835

Share Our Wines With Your Friends & Family

Description

MACD Divergence is a fully automatic indicator.

MACD DIVERGENCE: FULLY AUTOMATIC

It has never been easier to identify a divergence. There is only one indicator for ThinkorSwim that draws a MACD divergence.

Many of us have been able to simplify our daily process thanks to your script.

IDENTIFYING A MACD DIVERGENCE

HAS NEVER BEEN EASIER

GET THE ONLY INDICATOR FOR THINKORSWIM THAT ACTUALLY SHOWS A MACD DIVERGENCE

Using your macd divergence indicator has made a difference for me when trying to break the zero line.

Mike

![]()

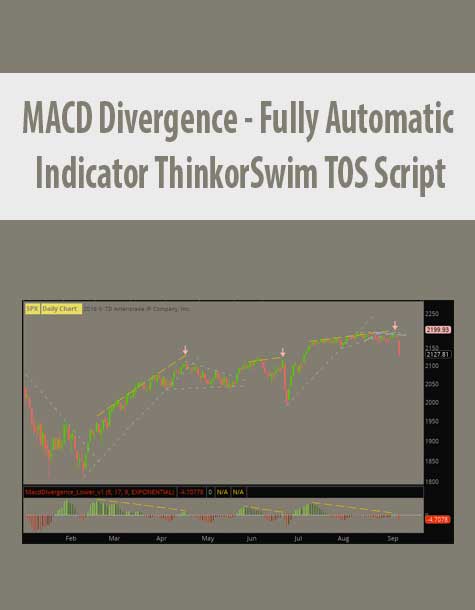

The Mechanical MACD Divergence and Automatic Trend lines are included in the screenshot provided.

Hi Robert,

The above script looks great for my type of trading. I’ve been using it on the mobile platform as well as on the P.C. platform. I would like to thank you for the great script, I know of no one else who has it, so it is a huge achievement.

I have set up the P.C. TOS platform so that it runs the scans on a watch list live. I can see if an alert is triggered even if I am not watching a symbol on the charts.

Kind regards.

Ted

I have wanted to create this indicator for a long time. None of the divergence indicators have lines drawn on them in the way that is shown in technical analysis books. It’s up to the user to manually spot and draw in those.

I spent a lot of time looking for a script that would do it automatically. I looked for help on how to draw the trend-lines, but never came up with anything useful. I didn’t know what I needed to know to draw the lines until I created my Basic Market Structure script. I was able to figure out how to do my auto-trend lines because of the knowledge I gained from writing that script. I was able to build from that one to the near-term divergence lines in the advanced market forecast indicator.

I knew I had the skills to create a proper MACD divergence study after I finished that one. One that no one else has.

I present the mechanical MACD Divergence indicator.

I came across several different methodologies for determining divergences while researching online. Alexander Elder detailed the classic MACD divergence in his book, The New Trading For a Living. Some of the most powerful signals come from divergences between MACD- Histogram and prices.

A classical bullish divergence occurs when prices fall to a new low and the oscillator rises above its zero line, then both fall again. Prices fall to a lower low, but the oscillator shows a higher bottom from the previous decline.

Alexander believes that the breaking of the centerline between two indicator bottoms is a must for a true divergence. Before skidding to its second bottom, MACD- Histogram has to cross above the zero line. There is no divergence if there is no crossover.

When prices reach a new high and then pull back, there is a classical bearish divergence. An oscillator reaches a lower peak than it did on a previous rally, but prices still rally to a higher high.

There is a mechanical MACD Divergence video demonstration.

Alexander Elder outlined the rules for bullish and bearish divergences. Bullish and bearish divergences are shown in different colors. The script settings panel can be used to change the colors and whether or not to show signal arrows.

Thinkscript is about mechanical MACD Divergence settings.

On any time frame, the indicator will work.

Both bullish and bearish divergences will be scanned with two scripts. The script can be tailored to work with any time period.

QUESTIONS

I would like to know if you could send me a 2 min screenshot of this indicator.

Is it possible to use Basic Market Structure with Automatic Fibonacci Levels, Auto-Trendlines, and MACD Divergence at the same time?

You can run all three on the same chart. The screen-shot shows the indicators on different time frames. The others are easy to spot on the other time frames.

Market structure, auto-TrendLines, and mechanical MACD Divergence are some of the topics covered in ThinkScript.

Is it possible that this works on currency pairs?

Yes, it does.

There is a mechanical MACD Divergence on 15 min.

Hi Robert,

You have attracted a lot of people who are like minded. Can the mechanical MACD Divergance script be used on the mobile papermoney platform?

I installed the mobile platform to see if it would work, and it did.

The mechanical MACD Divergence is running on a mobile phone.

UPDATE

The indicator has been updated to include both standard and volume-weighted methods. From the script settings pane, the user can choose which method to use.

ThinkScript is about mechanical MACD Divergence.

Delivery Method

PRODUCT DESCRIPTION

– After your purchase, you’ll see a View your orders link which goes to the Downloads page. Here, you can download all the files associated with your order.

– Downloads are available once your payment is confirmed, we’ll also send you a download notification email separate from any transaction notification emails you receive from nextskillup.com .

– Since it is a digital copy, our suggestion is to download and save it to your hard drive. In case the link is broken for any reason, please contact us and we will resend the new download link.

– If you cannot find the download link, please don’t worry about that. We will update and notify you as soon as possible at 8:00 AM – 8:00 PM (UTC 8).

Thank You For Shopping With Us!

OUR BEST COLLECTION OF COURSES AND BOOKS

Reviews

There are no reviews yet.