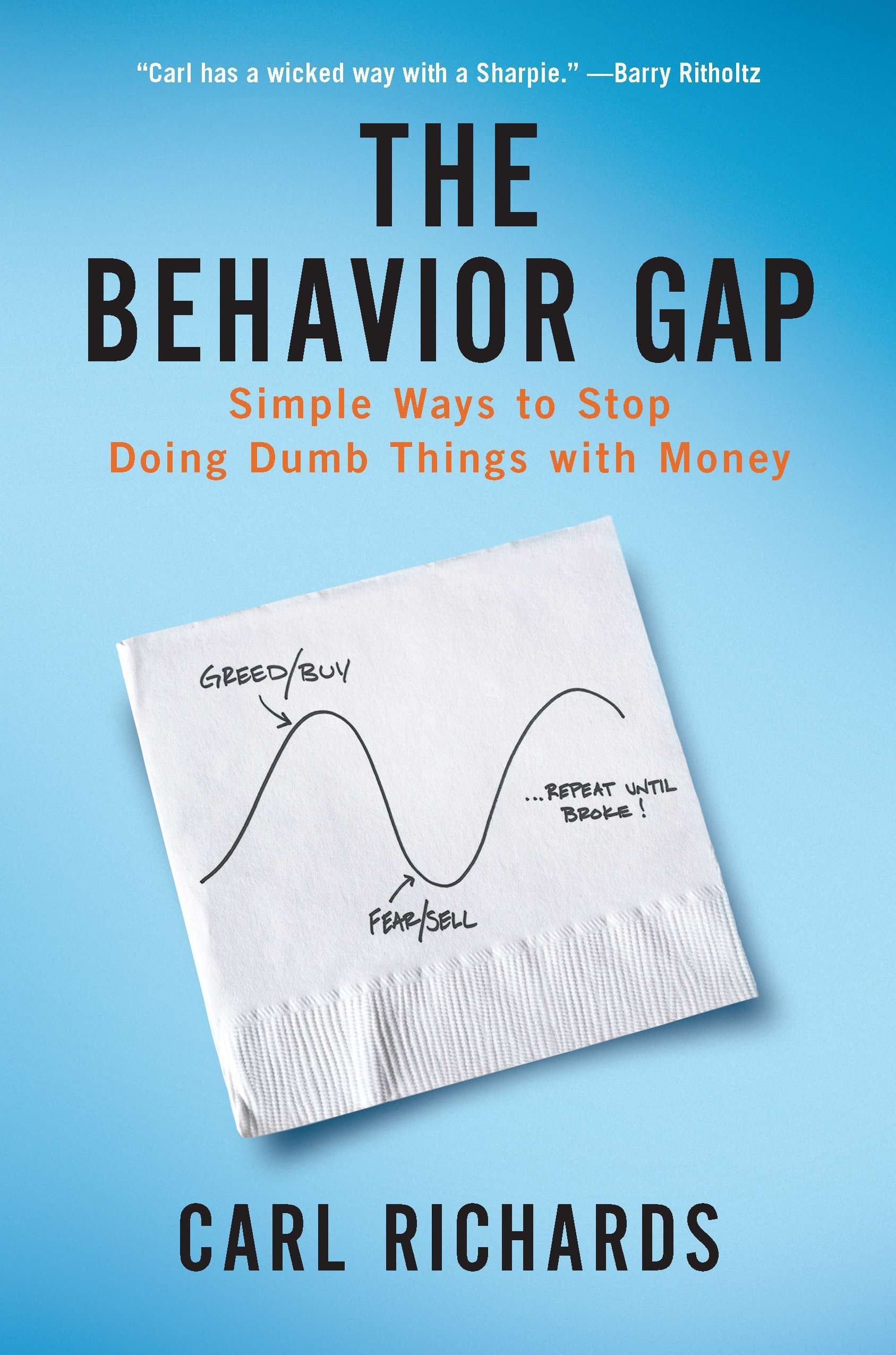

Carl Richards – The Behavior Gap: Simple Ways to Stop Doing Dumb Things with Money

Carl Richards – The Behavior Gap: Simple Ways to Stop Doing Dumb Things with Money

Carl Richards – The Behavior Gap: Simple Ways to Stop Doing Dumb Things with Money

Product Delivery: You will receive a download link via your order email

Should you have any question, do not hesitate to contact us: support@nextskillup.com

Original price was: $27.00.$11.00Current price is: $11.00.

59% Off

Secure Payments

Pay with the worlds payment methods.

Discount Available

Covers payment and purchase gifts.

100% Money-Back Guarantee

Need Help?

(484) 414-5835

Share Our Wines With Your Friends & Family

Description

Carl Richards – The Behavior Gap: Simple Ways to Stop Doing Dumb Things with Money

Carl Richards – The Behavior Gap: Simple Ways to Stop Doing Dumb Things with Money

It is not that we are dumb. We are wired to avoid pain and pursue pleasure. It makes sense to sell when everyone is scared and buy when everyone is happy. It may feel right, but it isn’t rational. From the behavior gap. Why do we lose money? The real trouble lies in the decisions we make.

Carl Richards became frustrated when he watched people make the same mistakes over and over. Emotions got in the way of smart financial decisions. The behavior gap is the distance between what we should do and what we actually do. He found that once people understood the gap, they started doing better.

His way with words and images has attracted a loyal following. The New York Times. His columns and lectures can be heard on National Public Radio. His book will show you how to rethink situations where your instincts can cost you money and peace of mind.

He will help you.

The tendency to buy high and sell low should be avoided. There are pitfalls of generic financial advice. Invest all of your assets-time and energy as well as savings more wisely. Spend money and time on things that don’t matter. Understand your financial goals. Start talking about money. You should simplify your financial life. It’s time to stop losing money.

It is never too late to start over. Richards writes that it’s time to give yourself permission to review those mistakes, identify your personal behavior gaps, and make a plan to avoid them in the future. The goal is not to make the perfect decision about money every time, but to do the best we can. That is enough most of the time.

REVIEW

Delivery Method

– After your purchase, you’ll see a View your orders link which goes to the Downloads page. Here, you can download all the files associated with your order.

– Downloads are available once your payment is confirmed, we’ll also send you a download notification email separate from any transaction notification emails you receive from nextskillup.com.

– Since it is a digital copy, our suggestion is to download and save it to your hard drive. In case the link is broken for any reason, please contact us and we will resend the new download link.

– If you cannot find the download link, please don’t worry about that. We will update and notify you as soon as possible at 8:00 AM – 8:00 PM (UTC 8).

Thank You For Shopping With Us!

OUR BEST COLLECTION OF COURSES AND BOOKS

Reviews

There are no reviews yet.