Carry Trading Advisor

Carry Trading Advisor

Carry Trading Advisor

Product Delivery: You will receive a download link via your order email

Should you have any question, do not hesitate to contact us: support@nextskillup.com

Original price was: $49.00.$40.00Current price is: $40.00.

18% Off

Secure Payments

Pay with the worlds payment methods.

Discount Available

Covers payment and purchase gifts.

100% Money-Back Guarantee

Need Help?

(484) 414-5835

Share Our Wines With Your Friends & Family

Description

Carry Trading Advisor

Sale page: http://forexop.com/products/mt4indicators/6500/

Archive page: http://archive.is/kcAS9

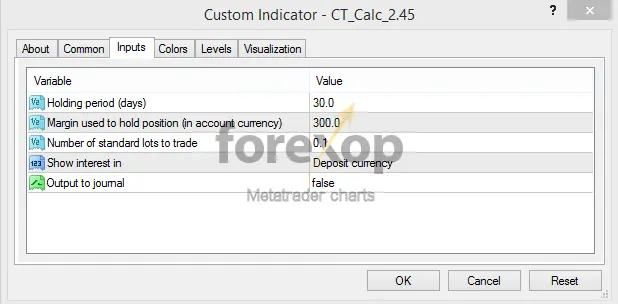

Carry trading strategies can be used with this Metatrader indicator. It is useful to keep an eye on the interest charges you are paying to your broker.

The tool can be used to calculate the following.

- The net interest amounts received (or paid)

- The net interest yield

- The annual rate of return

- The return on investment (for your margin amount)

- The broker’s interest rate spread (fee)

The indicator shows interest cash flows for both the long and short side of a trading position when attached to a chart. The indicator shows the interest rates for symbols in the market watch window. The broker’s average interest rate spread can be used as a fee comparison.

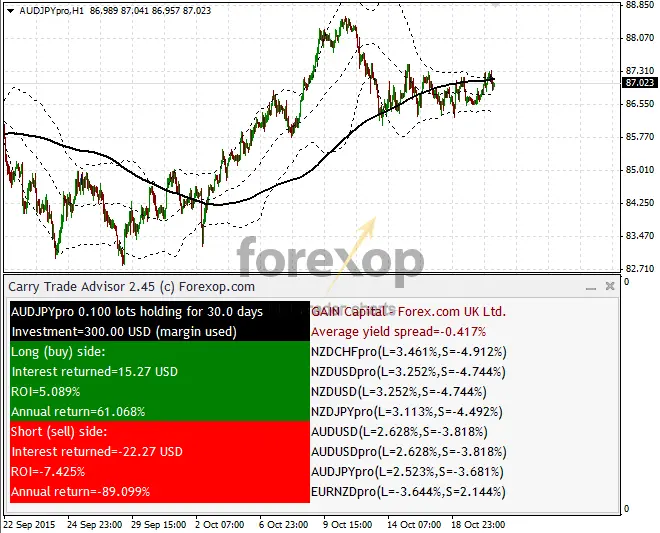

Example 1:

Suppose you want to know how much carry interest was received on the trade.

Buy lots of AUDJPY. The holding period is 30 days. The margin was used for the account currency. Deposit currency has an interest in it.

The chart has an indicator attached to it.

The result is displayed.

A mini lot is held for 30 days.

| AUDJY | Buy | Sell |

| Interest returned | $15.27 | -$22.27 |

| ROI | 5.09% | -7.43% |

| Annual return | 61.07% | -89.10% |

Buying and holding a mini lot position inAUDJPY for 30 days results in an interest payment ofUSD 15.27. The interest on the sell side would need to be paid.

The deposit currency isUSD and the margin isUSD 300. The return on investment is 5.05% for the 30 day carry trade. The annual return is 61.07%.

The display is green if a trade position results in positive cash flows.

The base currency or quote currency can be used to display the interest cash flows. Setting the margin amount in AUD will change the output to the base currency of the symbol.

| AUDJPY | Buy | Sell |

| Interest returned | AUD 21.04 | -AUD 30.69 |

| ROI | 5.09% | -7.43% |

| Annual return | 61.07% | -89.10% |

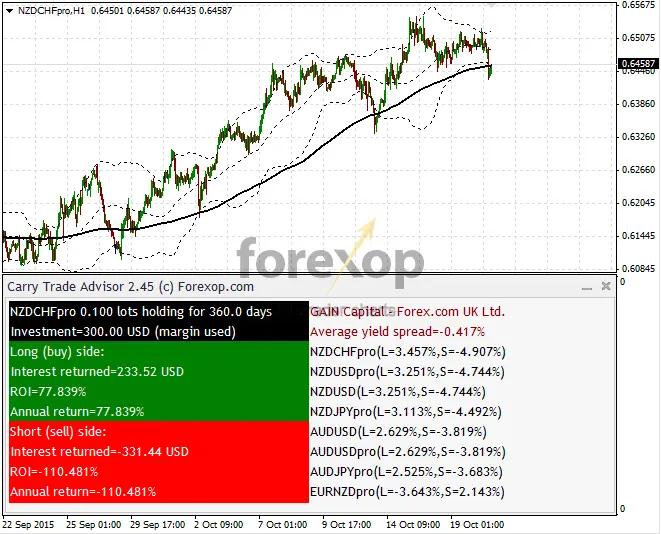

Example 2:

Purchase 0.1 x lots of NZDCHF. The holding period is for a long time. The margin was used for the account currency. Deposit currency has an interest in it.

The cash flows for both sides of the position are shown.

Holding a small amount of NZDCHF for a long time.

| NZDCHF | Buy | Sell |

| Interest returned | $233.52 | -$331.44 |

| ROI | 77.84% | -110.48% |

| Annual return | 77.84% | -110.48% |

The technical guide contains more information.

Delivery Method

– After your purchase, you’ll see a View your orders link which goes to the Downloads page. Here, you can download all the files associated with your order.

– Downloads are available once your payment is confirmed, we’ll also send you a download notification email separate from any transaction notification emails you receive from nextskillup.com .

– Since it is a digital copy, our suggestion is to download and save it to your hard drive. In case the link is broken for any reason, please contact us and we will resend the new download link.

– If you cannot find the download link, please don’t worry about that. We will update and notify you as soon as possible at 8:00 AM – 8:00 PM (UTC 8).

Thank You For Shopping With Us!

OUR BEST COLLECTION OF COURSES AND BOOKS

Reviews

There are no reviews yet.